In today’s volatile and cost-sensitive environment, the old procurement mantra – “better, cheaper, faster” – no longer suffices. Behind this simplicity lies a complex reality: raw materials, components, and services must be sourced, planned, and delivered across global networks under relentless pressure. Competitiveness is no longer assumed – it must be architected.

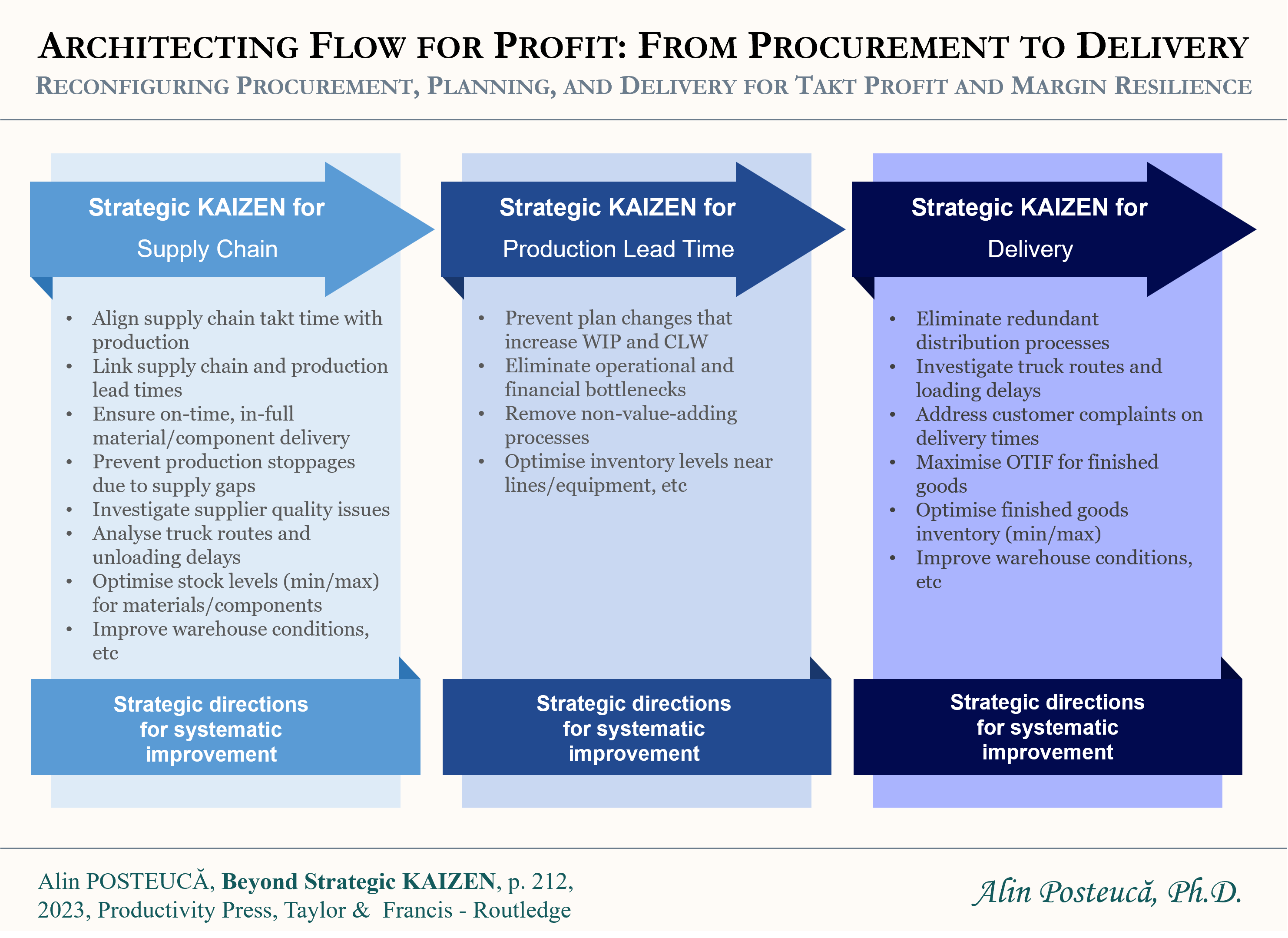

Strategic KAIZEN offers a new execution model. It does not optimise the familiar – it redefines it. Procurement, planning, and delivery are no longer siloed functions. They become synchronised levers of Ideal Takt Profit, governed by financial precision and designed for enterprise value creation.

- Supplier ecosystems are restructured to support strategic cost frameworks.

- Procurement becomes takt-aligned and responsive.

- Delivery is reengineered as a profit lever – not a logistical endpoint, but a differentiator of margin resilience.

- Waste and losses are not simply removed – they are located, measured, and dissolved.

- Improvement is no longer anecdotal – it is structured, visible, and financially justified.

This service responds to the real challenges faced by manufacturers and distributors:

- Lack of transparency around distribution cost benchmarks and realistic improvement targets

- Fragmented visibility between local initiatives and enterprise-wide outcomes

- Weak links between operational improvement and financial indicators

- Absence of structured methods for identifying and governing systemic losses

Strategic KAIZEN transforms execution from a reactive function into a designed capability – where every takt minute is synchronised with profit, and every decision is financially justified.

English

English Romana

Romana